Investment in securities market are subject to market risk, read all related documents carefully before investing. 10/order is available with Power Investor & Ultra Trader Packs. *Brokerage will be levied flat fee/executed order basis and not on a percentage basis. B-23, MIDC, Thane Industrial Area, Waghle Estate, Thane, Maharashtra - 400604 Regardless of the extent of the contract value, these brokers frequently impose a flat fee.ĬIN: L67190MH2007PLC289249 | Stock Broker SEBI Regn.: INZ000010231 | SEBI RA Regn.: INH000004680 | SEBI Depository Regn.: IN DP CDSL: IN-DP-192-2016 | AMFI REGN No.: ARN-104096 | NSE Member id: 14300 | BSE Member id: 6363 | MCX Member ID: 55945 | Investment Adviser Regn No: INA000014252 | Registered Address - IIFL House, Sun Infotech Park, Road no. Their fees are so typically on the higher side.ĭiscount brokers merely provide a trading platform and request a little fee in return. Research, sales management, advice, and a variety of other services linked to trading in securities are all provided by full-service brokers. When traders place large orders, certain brokers, however, reduce the percentage fee.īrokers in India typically fall under one of two groups: The volume affects how much brokerage is calculated on shares. It accurately compares the brokers.Īnother factor that significantly affects brokerage estimates, whether made manually or with the help of a brokerage calculator, is the volume of transactions. One of the key variables impacting brokerage fees in the stock market is the buy or sell price of a single security unit. The factors on which Brokerage Calculation Depends are: To acquire all the pertinent information, including the point needed to break-even, you must choose the pricing plan (value or power plan) and input the buy price, sell price, and quantity (number of lots and lot size), in the options brokerage calculator. The brokerage and other associated fees for currency trading at the NSE are displayed by this calculator. Additionally, it displays the break-even points. The brokerage and other associated charges for MCX commodity trading are displayed by this calculator. The break-even point, or price point at which net gains or losses (after deducting brokerage and other charges) are equal to zero, is also displayed by the F&O and share brokerage calculators. Trading on the NSE and BSE can be done using the intraday brokerage calculator. The brokerage and other associated fees for intraday equities trading, delivery equity trading, and F&O trading are displayed in this stock brokerage calculator. The fees are becoming more reasonable as broker competition levels rise. Intraday brokerage = market price of one share * the number of shares * 0.05%.ĭelivery brokerage = market price of one share * the number of shares * 0.50%. If the fees are 0.05 percent for intraday and 0.50 percent for delivery, then

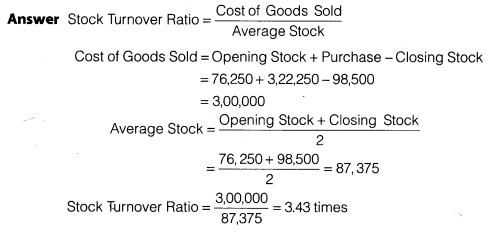

Consequently, the brokerage formula is as follows. The brokerage is computed based on the total cost of the shares at the chosen percentage. Before purchasing and selling stocks, they can simplify the cost analysis process by using an intraday brokerage calculator. As a result, it is designed for traders that heavily rely on timing to execute their bets like intraday traders. Quick and efficient trading is made possible by a brokerage calculator, which promptly delivers correct information about such charges. To determine their cost of trading, a person would need to enter the following data into an online brokerage calculator. Additionally, it computes transaction fees, GST, and Securities Transaction Tax (STT) as well as stamp duty fees.Ĭonsequently, a brokerage charges calculator greatly streamlines the process of figuring out the cost of a trade. A brokerage calculator can do more than just figure out the brokerage, though. Brokerage Calculator is an online tool offered to traders by brokers and other investment platforms to make it easier for them to calculate brokerage before making a trade.

0 kommentar(er)

0 kommentar(er)